Home Office Expenses 2024 Sars – Typically, an employee must be required to work from home in order to claim a deduction for home office claim expenses under a separate “business-use-of-home” regime. The CRA has not provided . But for the 2023 tax return, which is generally due on April 30, 2024, employees who wish to claim home-office expenses will have to go through the tedious exercise of tallying all their expenses, .

Home Office Expenses 2024 Sars

Source : m.facebook.comHabitat for Humanity of South Sarasota County will build Venice house

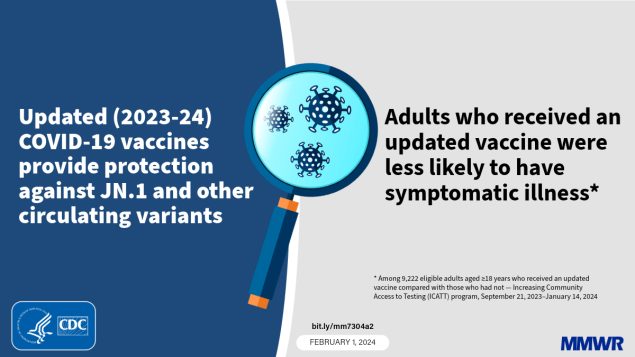

Source : www.heraldtribune.comEarly Estimates of Updated 2023–2024 (Monovalent XBB.1.5) COVID 19

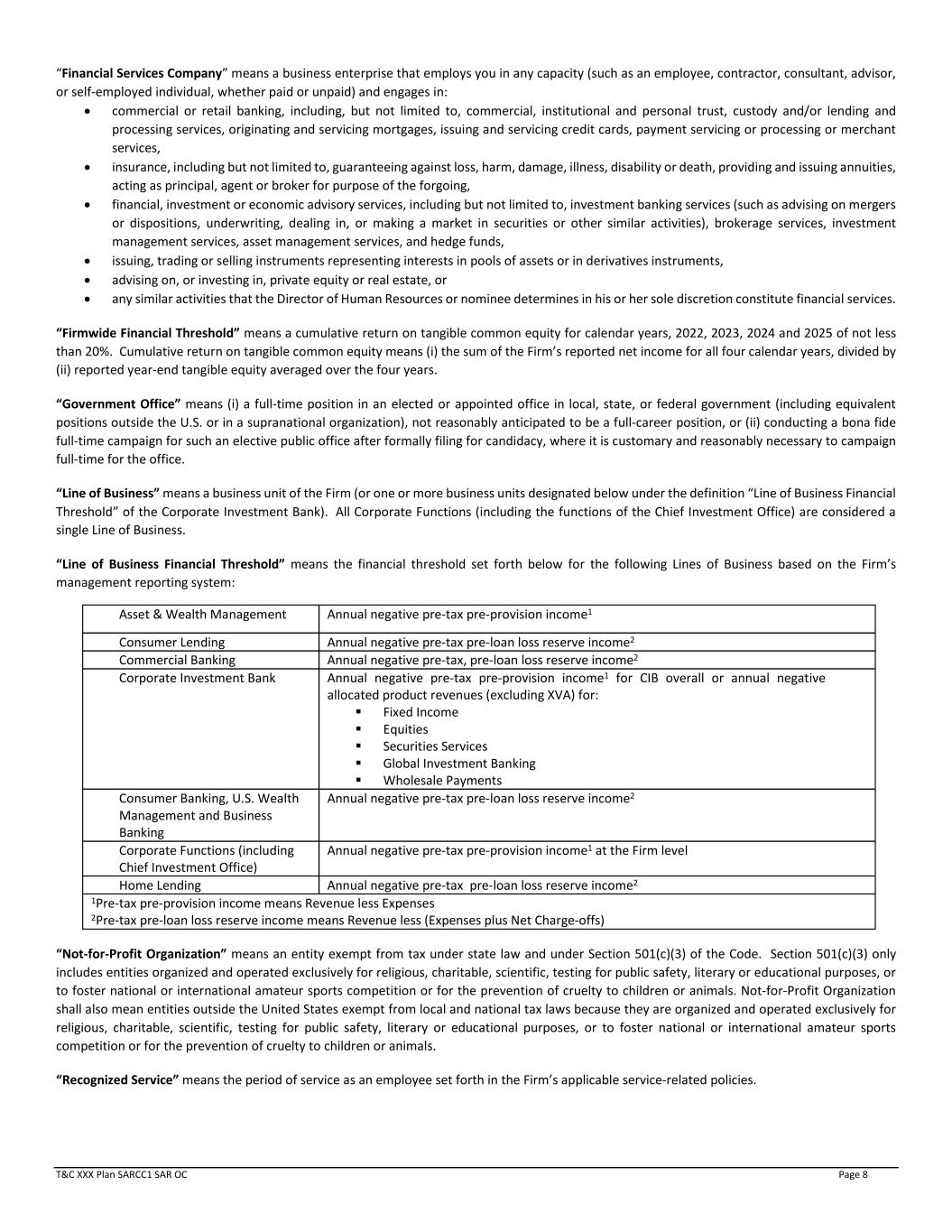

Source : www.cdc.govtermsandconditionsp

Source : www.sec.govSEC Filing | JPMorgan Chase & Co.

Source : jpmorganchaseco.gcs-web.comSAR EL The National Project for Volunteers for Israel

Source : www.sar-el.orgTWU Institute of Health Sciences Houston Center | TWU

Source : twu.eduSARS Tax Deductible Business Expenses QuickBooks South Africa

Source : quickbooks.intuit.comHome Page: Journal of Oral and Maxillofacial Surgery

Source : www.joms.orgAntibiotics | January 2024 Browse Articles

Source : www.mdpi.comHome Office Expenses 2024 Sars Mgt accounting and consulting: To deduct your mortgage interest, you’ll need to fill out IRS Form 1098, which you should receive from your lender in early 2024 5b of 1040 Schedule A. Home office expenses can be deducted . Under the tax law, certain requirements for out-of-town business travel within the United States must be met before you can .

]]>

/prod01/twu-cdn-pxl/media/hero/houston-feb-2024-hero.jpg)